How Problems Show Up in Roofing Data Before You Feel Them

In the competitive roofing industry, staying ahead of potential issues is crucial. By examining roofing business data, you can identify problems before they escalate. Understanding how operational, financial, and people issues manifest in your roofing company metrics can prevent emergencies and help maintain a smooth operation.

Missed Signals in Roofing Business Data

Roofing business data can be rich with insights, but many contractors overlook signals that point to future issues. Even worse, sometimes it's hard to have all your data up to date and in one place, in order to see the signals to begin with. Operational inefficiencies may first appear as slight delays in project timelines or increased material wastage. Financial problems might surface as subtle fluctuations in cash flow, and employee dissatisfaction could be reflected in decreasing productivity metrics. Ignoring these minor discrepancies can lead to major operational setbacks, underscoring the value of a vigilant approach to data analysis.

Why Owners Rely on Gut Feel

Many roofing business owners trust their instincts, a valuable asset honed through years of experience. However, relying solely on intuition can have drawbacks. Physical inspections and personal observations are essential, but they can sometimes miss underlying trends that data captures. Balancing gut feeling with insights from roofing performance dashboards allows for a more comprehensive understanding of your business landscape.

Early-Indicator Roofing Metrics to Keep an Eye On

Below are leading indicators—metrics that tend to move before revenue drops, crews quit, or cash runs dry.

Sales & Pipeline Metrics (Problems show up here first)

Lead response time

When response times creep up, close rates usually drop a few weeks later.Estimate-to-close ratio

A declining close rate often signals pricing issues, sales process breakdowns, or increased competition—long before revenue dips.Average days from inspection to contract

Longer sales cycles can indicate internal bottlenecks or customer trust issues.Backlog value vs. crew capacity

A shrinking backlog often precedes slow months; an overloaded backlog predicts missed deadlines and burnout.

Operations Metrics (Where chaos quietly starts)

Jobs completed on schedule (%)

Small slips here often turn into customer complaints and margin erosion later.Material variance (estimated vs. actual)

Rising variance is an early sign of estimating errors, theft, or supplier issues.Rework / punch-list frequency

Quality problems almost always appear in rework data before they show up in reviews.Average job cycle time

When jobs take longer than usual, overhead increases before anyone notices.

Financial Metrics (Cash problems whisper before they scream)

Gross margin by job type

Declining margins usually start with one job type or crew, not the whole business.Accounts receivable aging

More invoices slipping past 30–60 days is often the first sign of future cash crunches.Cash runway (months of expenses covered)

This drops quietly long before payroll becomes stressful.Overhead as a percentage of revenue

Rising overhead doesn’t hurt immediately—but it limits growth and flexibility later.

People Metrics (Turnover starts long before resignations)

Revenue per crew / per employee

Declines here often indicate morale issues, training gaps, or leadership strain.Overtime hours trend

Sustained overtime predicts burnout, mistakes, and turnover.Absenteeism or call-outs

Small increases often precede resignations or disengagement.Crew utilization rate

Low utilization points to scheduling issues or pipeline misalignment.

Customer Experience Metrics (Reputation erosion starts quietly)

Job-to-review ratio

Fewer reviews per job often signals declining customer enthusiasm.Repeat or referral job percentage

A drop here usually shows up before marketing costs spike.Change order frequency

Rising change orders can indicate estimating or communication breakdowns.

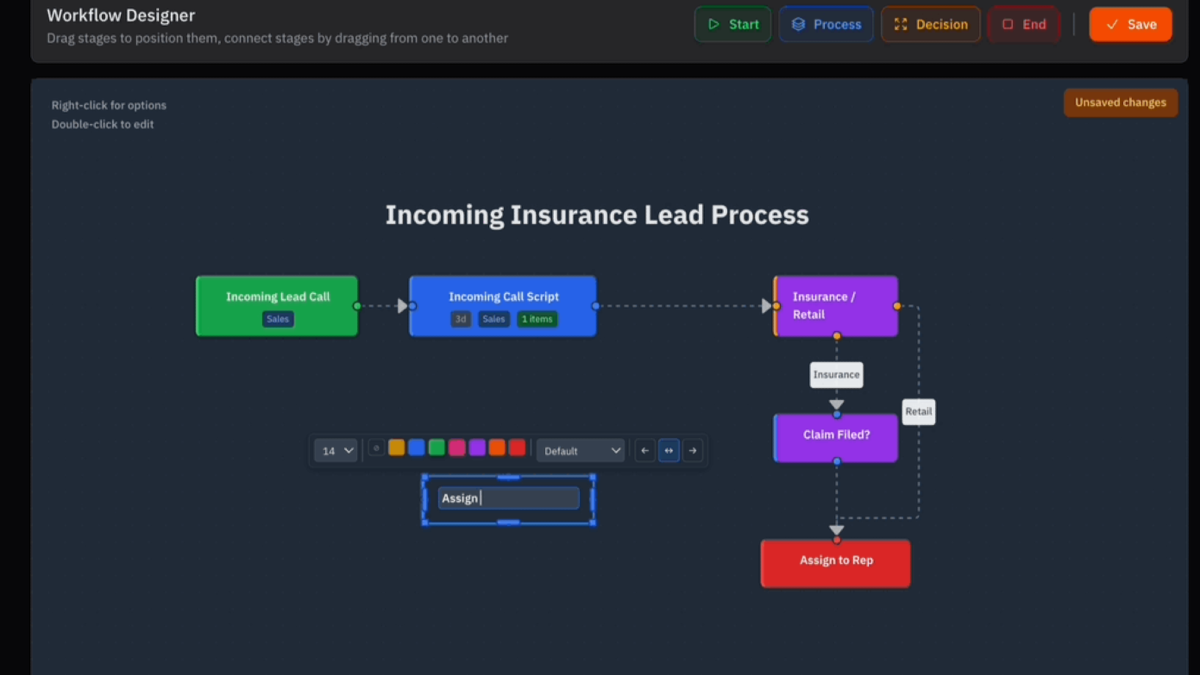

How Systems Surface Issues Earlier

Implementing roofing business management software can illuminate early warning signs in roofing businesses. These systems consolidate data, providing a comprehensive view of your operations. By setting up alerts and performance indicators within the software, owners can receive timely notifications about anomalies, such as unexpected cost overruns or declining customer satisfaction. This proactive approach empowers contractors to address issues before they morph into crises.

By leveraging roofing company metrics, contractors can transform potential challenges into manageable tasks. Early detection through data not only prevents costly emergencies but also fosters informed decision-making, ensuring sustained growth and success in an ever-evolving industry.